Forex Market Trading May12 Aftermath

Forex Market Trading May12 Aftermath - As expected, the dollar lost more ground today falling 101 pips against gbp and 73 pips against eur. In my Forex Market Trading May12 Preview,

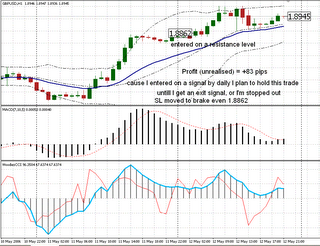

I said 1.90 in gbp will be hit soon. It was hit today, when gbp climbed to 1.8996-1.8999. It hit resistance there and fell, closed at 1.8945. That fall was partly caused by better than expected US trade balance report.

I entered at 1.8862, I found some support there. As I said in the forex market trading may12 preview, there was a good woodies cci signal - ZLR on gbp daily chart. The trade went well, and at around +50 pips I decided to go for brake even. Gbp rose to 1.90 as I said, I had a profit of +130 pips at one time, but I got to stick to the plan, the signal was at daily chart, so I should look for exit on daily, or if I'm stopped out by big adverse move. I'm currently at + 83 pips, unrealized profit. I normally don't hold trades over the weekend, but with the dollar being so weak, it seems ok, we'll see. My stop is at brake even.

Forex market trading for the eur went pretty much the same as gbp, it gained against the dollar too. Eur hit a hi of 1.2955 and closed at 1.2926. Obviously 1.30 is the next test level for the eur. The same goes for 1.90 for gbp.

That's all. Thanks for reading my forex market trading may12 aftermath.

2 Comments:

what are the sttings you use for the CCI?

Nice Blog, Thank You.

Mario

I'm currently using 20 period cci on all my charts, recently I've started to experiment with 14 period, but it will be a while before I include it (if I include it at all) on my charts.

I got to see how it behaves on a chart. I switched to 20 cci after finding 14 period too responsive.

I mainly use the ZLR's pattern, so 14 or 20 period cci, they basically give ~about the same signals. But I think they differ quite a bit on the exits, 14 cci gets me out way too early.

Anyway I use 20 period on all my charts for now, but I keep testing 14 cci too.

Thanks, and post again, all questions are welcomed.

Post a Comment

<< Home