Forex Market Trading May23 Aftermath

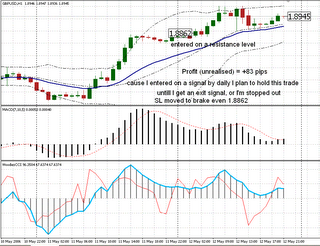

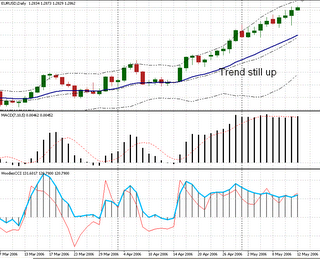

Forex Market Trading May23 Aftermath - The dollar gained more ground yesterday, gaining 79 pips against the euro and 86 pips against gbp. In the forex trading news, Credit rating agency S&P upgraded Japan's debt rating to positive from stable, highlighting continued improvement in the economy. However, the upgrade will keep the pressure on the BoJ to soon shift from its current zero-rate policy and recognize further recovery in its economy.Despitee this the dollar gained 72 pips against the yen.

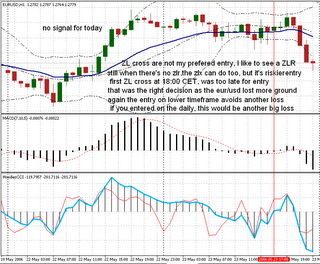

In yesterday's forex market trading we had a woodies cci signal, a zero line reject, but it failed again. As you can see from the 1 hour euro chart, the euro failed to make a zlr in yesteday's forex market trading. It did make a zero line cross, but it was at 18:00 CET (central european time), too late to enter. As you can see from the chart, I prefer zero line reject woodies cci pattern on lower timeframe too, but when there isn't one, I might take a zero line cross. This is a riskier entry however.

Still the reqirements for entry on lower timeframe avoid another loss, and if entered based on daily chart alone, you would probably take a big loss in yesterday's forex market trading.

Thanks for reading my blog, all comments and questions are welcomed. That's all for today's forex market trading may23 aftermath.